Like an impenetrably thick cloud of dust, panic and uncertainty linger over the world's economies.

In the wake of deepening world recession and the most serious international financial crisis in most lifetimes, people around the globe have been cashing in their holdings of rubles, yuan, pesos, rupees, etc. for positions in the good 'ole US dollar. According to some sources, 1000's of factories in emerging economies like China are closing every week. What is the average Joe to do? Look for opportunity because buddy, it's knocking.

Exhibit 1: Barack Obama

Barack Obama has rocketed out of nowhere to become the first black president of the USA. Using a steady call for change, Obama accomplished the seemingly impossible by capturing the attention and imagination of the young and disenfranchised. As the savings of America's middle class evaporated into the ether, Obama's call came to resonate across the board, leading to a landslide victory. But Obama's message has reverberated beyond the boundaries of the USA. Now, the world is looking to Obama with hope towards better times.

Exhibit 2: $2/gal Gasoline

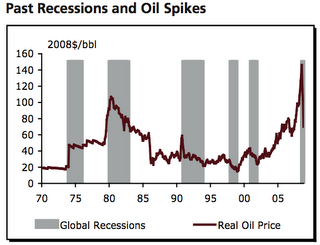

Since the 1970's, rising crude oil prices have been triggers in 5 out of 6 global economic recessions. Once crude prices begin to fall, every global recession in at least 30 years has ended within 3 years. With crude plummeting from it's all time high this July of $147/barrel to it's current price of $62, the clock on this recession has begun to wind down. Why? Because sharply lower transportation costs makes it cheaper to bring goods to market, giving manufacturers room to lower prices, stimulating sales and profits.

Since the 1970's, rising crude oil prices have been triggers in 5 out of 6 global economic recessions. Once crude prices begin to fall, every global recession in at least 30 years has ended within 3 years. With crude plummeting from it's all time high this July of $147/barrel to it's current price of $62, the clock on this recession has begun to wind down. Why? Because sharply lower transportation costs makes it cheaper to bring goods to market, giving manufacturers room to lower prices, stimulating sales and profits.Exhibit 3: DOW Industrial Average Leveling Out

The DOW Industrial Average has been going nuts since 1994, trading from 4000 to over 11000 in just 5 years. After readjusting in 2002-2003, it began climbing like crazy again, rising in October '07 to a never before seen high of over 14000. Obviously, a realignment was coming and the one we had last month was huge but there is reason for hope. The DOW has risen 1000 points from its October 27th low of 8175, due to the resolve that was displayed by the U.S. federal government via the huge $700+ billion bailout package.

The DOW Industrial Average has been going nuts since 1994, trading from 4000 to over 11000 in just 5 years. After readjusting in 2002-2003, it began climbing like crazy again, rising in October '07 to a never before seen high of over 14000. Obviously, a realignment was coming and the one we had last month was huge but there is reason for hope. The DOW has risen 1000 points from its October 27th low of 8175, due to the resolve that was displayed by the U.S. federal government via the huge $700+ billion bailout package.Nobody knows how long the economic crisis will continue or how bad it will get; however, things are already improving. Companies are becoming leaner and more productive. People are refining their job skills to increase job opportunities in our innovation and tech driven world. The war in Iraq will soon end, freeing hundreds of billions in tax revenues from being thrown away in Iraq. The development of affordable, alternative energy solutions will decrease dependence on foreign oil and the transfer of America's wealth to the nut jobs of the world. Housing prices are stabilizing, costs of living are falling and healthcare will improve.

The key really is change. We as a people must be more prudent with our wealth, investing in our future by increasing savings and decreasing what we owe. We need to live within our means rather than mortgage our kids' futures. Instead of paying dues to a health club, ride your bike regularly to work. With the newly passed Bicycle Commuter Act, you can even get a bike for free courtesy of reimbursements through your employer. This could even lead to doing away with your car completely, saving most people $8000-15000/yr (per AAA). My point is that we all need to act with more responsibility. The sooner we do, the sooner this mess will be over.

No comments:

Post a Comment